open end lease accounting

An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. At the end of the lease period.

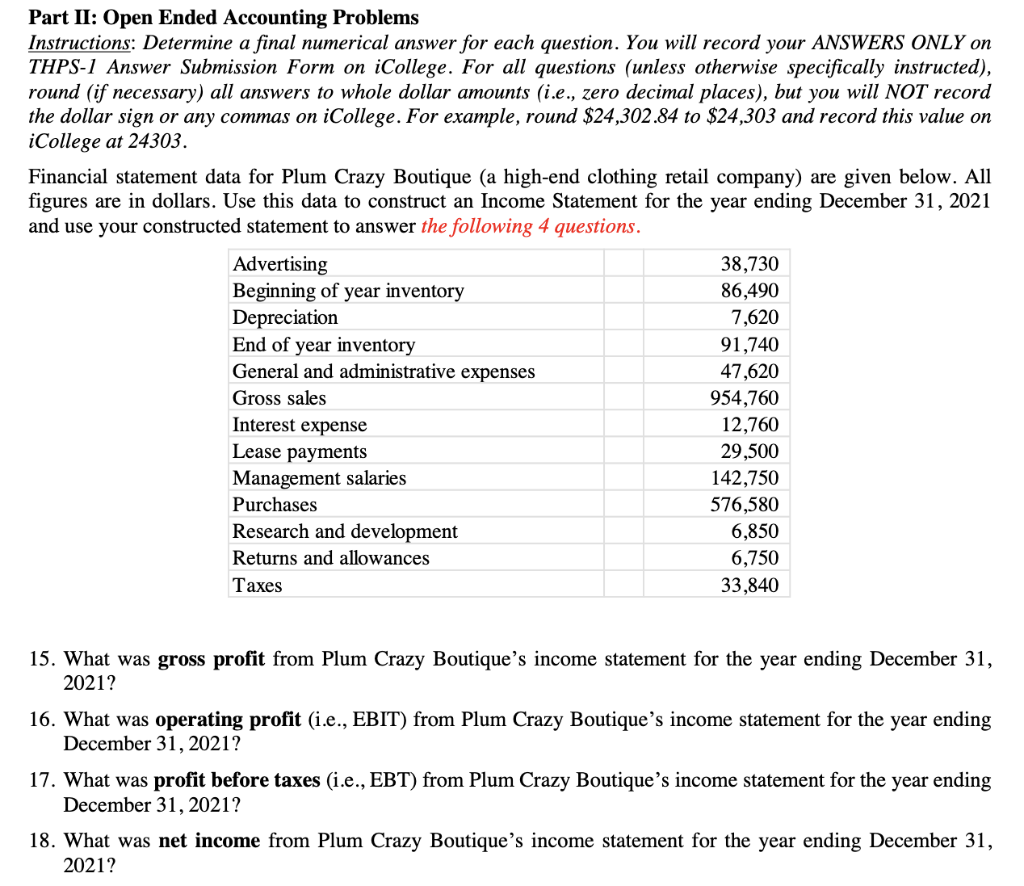

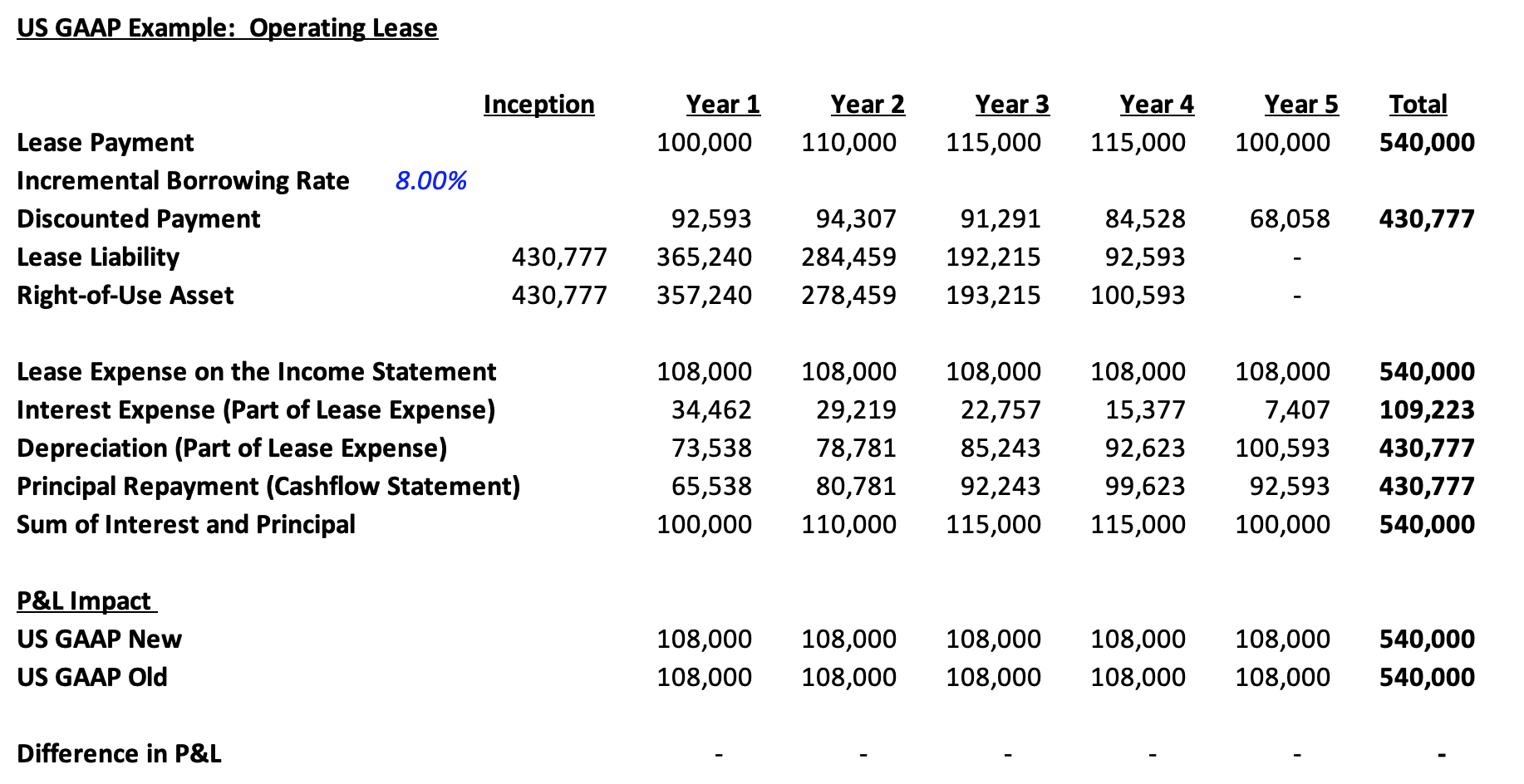

Operating Lease Accounting Double Entry Bookkeeping

In an operating lease the lessee records.

. The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes. The guaranteed amount declines over the lease. The Manager in Open-end Fund Accounting will be responsible for maintaining the books and records for open-end funds closed-end funds and collateralized loan obligation portfolios.

CALIFORNIA NEW CAR DEALERS ASSOCIATION DEALER MANAGEMENT GUIDE 16th EDITION By Manning Leaver Bruder Berberich Attorneys Los Angeles California California New Car. Treat each underlying asset as a separate component lessor and lessee and allocate the contract price to each component based on professional judgment and reasonableness. The lessee can buy an asset at the end of term at a value below market price.

An open-ended vehicle lease where there is an obligation to purchase the car at the end of the lease is an example of a finance lease. Open End TRAC Leasing Matthew Weitzel 2020-11-05T1440410000 Open End Lease TRAC Leasing If youre looking for a way to add vehicles to your fleet with greater flexibility you may. Typically an open-end lease is cancelable by the lessee after a minimum period with the lessee guaranteeing a residual value on cancellation.

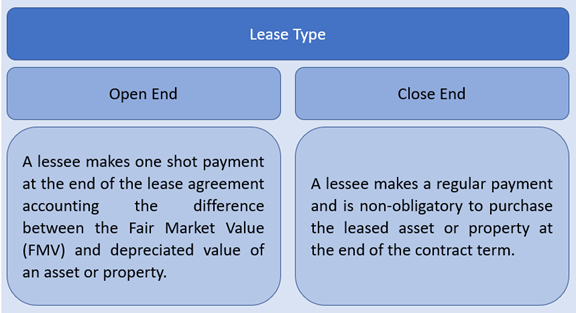

In a closed-end lease the lessor takes on the depreciation risk. In an open-end lease you may receive a refund of any gain and you are responsible for any deficiency. A closed end lease is a lease agreement that puts no obligation on the lessee the company or person making lease payments to purchase the leased asset at the end of the agreement.

Ending a month-to-month agreement Landlord. The lease term comprises at least 75 of the useful life of the asset. A 30-day notice is.

For example if your lease early termination payoff is 16000. The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes. A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of identified property plant and equipment for a stated period of time in.

You can end a month-to-month agreement and move out by giving your landlord a 30-day written notice.

Steps To Make Vehicle Leasing Mainstream In India

Lease Accounting Standard Japan Leasing Association

Lease Accounting Software Fasb Iasb Compliance Mri Software

New Lease Accounting Standards Vehicle Leasing Leaseplan

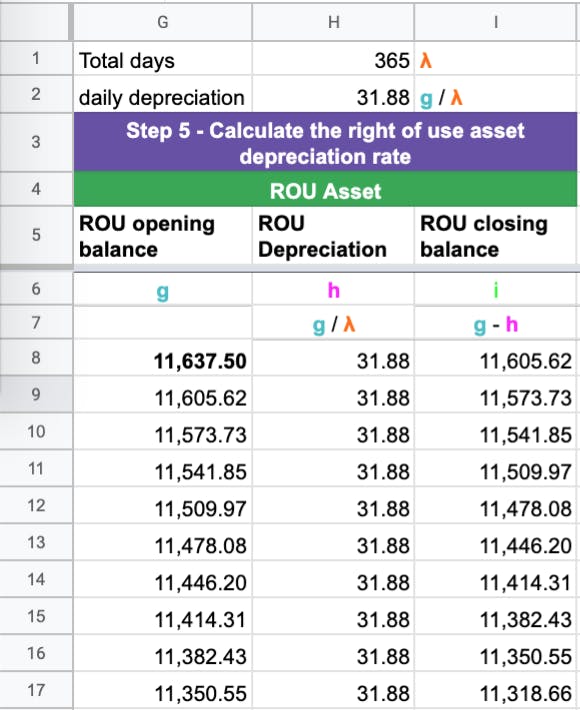

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Open End Vs Closed End Leasing 5 Point Comparison Table

Operating Lease Accounting For Asc 842 Explained W Example

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Configuration Of Lease Accounting Sap Blogs

Accounting For Leases The Marquee Group

What Trac Leases Are How They Work Merchant Maverick

Lease Accounting In Sap An Overview Sap Blogs

Financial Reporting Developments Lease Accounting Accounting Standards Codification 842 Leases Ey Us

Lease Accounting For Sales Type Lease Gross Profit Guaranteed Ungaranteed Residual Youtube

Capital Lease Vs Operating Lease What S The Difference

Lease Accounting In Sap An Overview Sap Blogs

Lease Definition Meaning In Stock Market With Example

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy